I have always been interested in learning more about fundamental difference between public and private companies. As second quarter of BGI rolled around, we were picking companies

to investigate. Initially, my group selected a company that we thought was publicly held. It was not, which made our task of analyzing their financials

nearly impossible. At the same time, I work for a company that is proud to be

private. One of the first things I heard during new hire orientation was that

“we do not have an exit strategy”…in other words, selling out was not on the

table.

With public vs. private swirling in my head, I have been picking

up on this difference in the news, and trying to figure out what role this

distinction plays in how a company moves forward with sustainability.

This week, I heard a report on NPR regarding how a

shareholder at Starbucks was outraged at the possible impact the company

support of DOMA (the Defense of Marriage Act that supports same-sex marriage)

had on it’s earnings. According to this shareholder, his profitability as an

investor was tarnished by this “people” driven corporate value made public.

Now, there is no conclusive evidence that this public support of homosexuality

actually did have a direct impact on the stock price, but it made me think

about the implications of other sustainability metrics, and how large

(typically publicly held) companies can realistically move these items

forward with shareholder opinion.

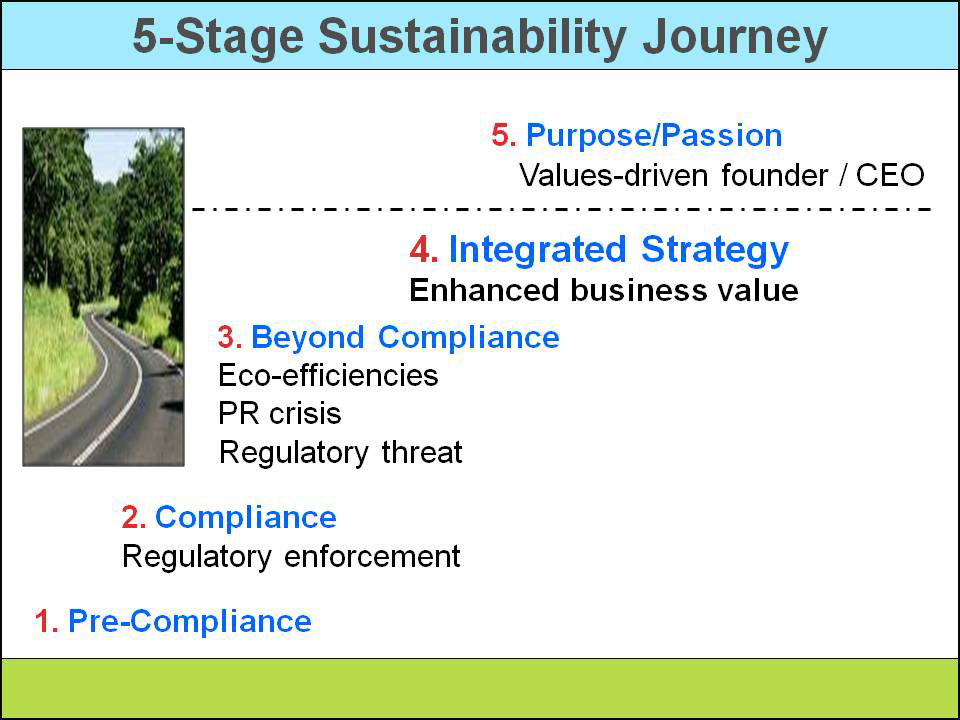

As we learned from Bob Willard, companies can be sorted into five stages of integrating sustainability into their daily operations. These range

from the earliest and most reactive stage of pre-compliance, to the purpose

driven sustainability companies that embody these values from the top-down and

inside-out. I would say that Starbucks in relatively proactive in their

sustainability goals, somewhere between stages 3 and 4 on Bob Willard’s diagram

below.

Why would this distinction be important? The example from

Starbucks is a great one. Clearly the leadership values differ from some of those

within their large group of shareholders. Since a key mechanism of publicly traded companies is responding to shareholder pressure, it sounds realistic

that sustainability measures and values (of which “people issues” are a large

part in the case of same-sex support) would be more likely to cave to

shareholder values if they do not align with corporate values. This leaves an

opening for influential decisions to be driven by outside people, potentially

driving a company on a course different from it’s core values. I found it

powerful that the Starbucks CEO responded to shareholders disapproval of

company support for marriage equality can invest somewhere else. Schultz

stated, “if you feel, respectfully, that you can get a higher return than the

38 percent you got last year, it’s a free country. You can sell your shares of

Starbucks and buy shares in another company. Thank you very much.” It will take

leaders with this personal drive to lead these publicly traded companies

towards a value based, sustainable future.

I do make an assumption here, that companies will or do

value sustainability, and are trying to push that agenda forward. For the

purpose of this article, sustainability (people, planet and profit in balance)

is the value proposition that I am hoping companies will protect. Clearly, not

all companies value these things, but likely face challenges to whatever their

value set when shareholders become involved once a public company.

In contrast to this is the company that I work for, which is

privately held, and pursues direction based on the core values of our

leadership team and CEO. These values have evolved over time, and are driving

further and further to defining how we will embody sustainability in the

future. Our mission has actually changed in the past two years to more

specifically call out considerations for protecting the planet, a clause that

had been missing in the past.

We are not subject to shareholder input and responding to

our values impacting profitability. Everyone with a stake in the company (as

either an owner or employee) is reminded constantly that we answer to no one

but ourselves and I believe that this will give us, and other private

companies, more leverage to move the needle on a sustainable business future.

Over the course of the week, I considered the differences further,

and came up with a possibility that perhaps the publicly traded companies may

have an advantage as public perception continues to evolve. Public pressure can

be incredibly powerful and could end up being the final push that move lagging

companies to incorporate sustainable goals into their operations. Ultimately, I

believe it is a societal value shift that needs to happen, and public and

private companies will have their own paths to evolve with this shift.

You bring an interesting argument to the table, one that I had not considered, that there may be a greater leverage point on publicly traded companies to change to sustainable practices. I think one element is that although public pressure can have its influence, a company culture must be changed from within. I think this is true in the short run, but your argument makes sense when the reality is that we can not change all companies from within and pressure on a system must come from somewhere.

ReplyDeleteLauren, this was a great post and a catalyst for my post this week. I still think back to the first intensive, when Marjorie Kelly gave a talk on the structure of ownership. She noted that once a company goes public, the structure will squeeze them into maximizing shareholder value (read pecuniary increases in value) no matter what their stated or desired values are. We only have to look at the current dialogue about local and alternative investing to realize what she is talking about. One of the biggest critiques is that no one will invest in projects that earn less than the mythical 10% year over year or better earned by the stock market. When your mandate is 10% growth in shareholder price, it is hard to prioritize anything else.

ReplyDeleteAlso, just a quick clarification, the DOMA is actually anti-same-sex marriage as it is the federal law preventing any federal benefits from flowing to any marriage not between a man and a woman regardless of state laws and definitions of marriage. DOMA is something we need to change/abolish, not support.

Lauren, good job here on connecting some dots: public vs. private, sustainability driven vs. financially driven. I'll offer a few of my own observations in the hopes of stimulating further reading/writing on your part.

ReplyDeleteFirst, the big news is that is mounting evidence that the presumed tradeoff between sustainability efforts and financial performance either does not exist -- or runs in the other direction. Smart companies, by and large, are getting on the sustainability bandwagon for all the good reasons that Bob Willard has offered. When he first started making his case 10 years ago, it seemed like wishful thinking -- increasingly, it is where the mainstream of business is going.

Thank God!

There is, however, a tradeoff between expenditures in the current period and benefits in a future period -- and that's where the public company issues really come to bear. The broad issue is one that is usually called "short termism" and it affects everything from marketing and R&D budgets to investments in automation to investments in sustainability. Anything that hurts quarterly earnings is likely to affect stock price (and thereby make some shareholders mad)-- regardless of its wisdom in the long term.

Unless, that is, the CEO has the courage to tell short-term investors that they should take their investments elsewhere. This takes a lot of courage and is particularly difficult if it represents a change in course, leaving some legacy investors holding the bag as the market adjusts its expectations. And, of course, these investors love to file lawsuits to enforce their positions (and hassle management in the hope of a profitable settlement).

Two examples of CEOs with courage: Jeff Bezos (whose politics are significantly to the right of mine), who has consistently said that he is not running his company by kowtowing to investors. Anyone who wants to come along for the ride is welcome to do so (and has profited handsomely!), but he runs the show and he runs it for the long term.

An example closer to our sustainability values is Paul Polman, the new president of Unilever, who has articulately advanced a very big sustainability vision. His first act as CEO (on his first day!) was to tell the analyst community that Unilever would no longer advise analysts on expectations regarding quarterly earnings. This was his first step away from the Wall Street speculator-driven stock market. Much much more to come -- watch him!