Norm wrote about this notion on his blog recently as well; the idea of a zero growth society. Norm states the emerging economies, like

those of China, India, Brazil, Russia etc., seek the same levels of

consumption that the rich nations of the world enjoy today. This rich

level of consumption and production is more than our planet can provide. Our

global consumer culture and the nature of our economic system are predicated on

constant economic growth. In order to address the problem of global

warming we will need a different culture and a different economic system.

We cannot continue in the current projection of social value

being solely measured by economic growth. At some point we will reach a

critical tipping point, and will be forced to explore other endeavors to obtain

satisfaction and prosperity in our lives. I know that this movement is

happening, particularly among many of my peers and classmates. We are exploring

what is really important, and how we can continue to develop as contributing members

of society, while balancing that with a sustainable future.

We at BGI are not alone in this movement. There are many

examples of community level actions, like the “Move Your Money” and “bank

transfer day” campaigns; widespread efforts to shift millions of dollars from

corporate institutions like Bank of America to community-benefiting institutions.

Related to this are other “new banking” strategies. Since 2010, 17 states, for

instance, have considered legislation to set up public banks along the lines of

the long-standing Bank of North Dakota.

But how big is this movement? Those of us that see the need

to change these structures are still faced with the challenge of slowing down a

massive flywheel that has been cranking along long before any of us were born.

The momentum is staggering. Sure, I can move my money into a credit union, and

work on supporting local community businesses that will feed back into a

smaller scale economy, but what about influencing the bigger picture.

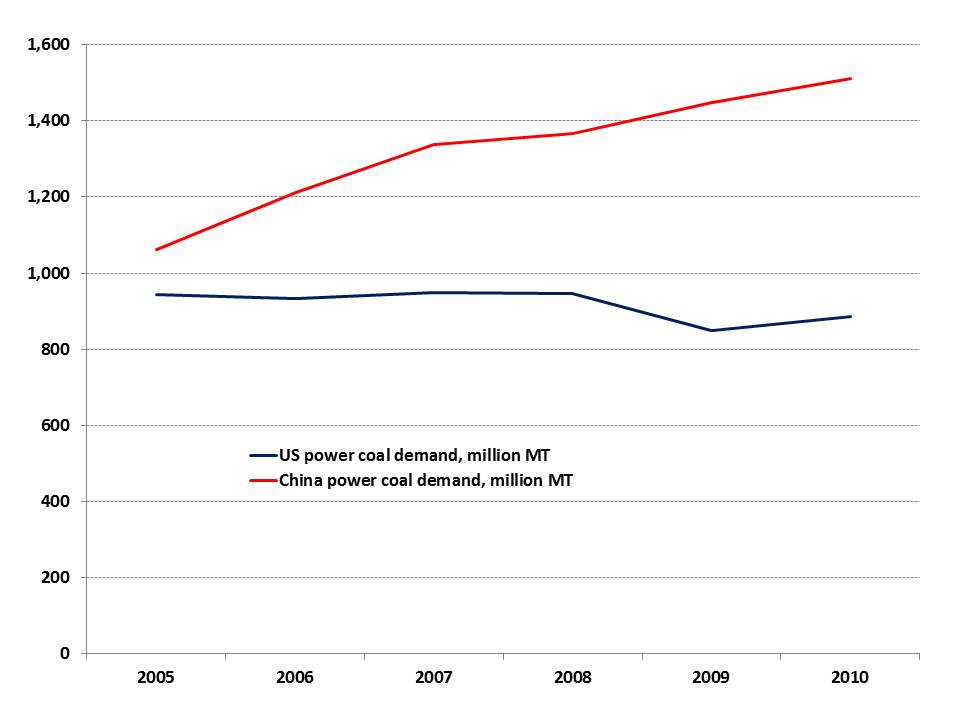

Coal exports are a prime example of people speaking out

against the momentum, and struggling to make inroads with the scale of these

heavily funded projects. Information is out there. People care. Last week, one

of my BGI classmates’ 10 year old daughter, Olive, stood up at a town hall

meeting to give a speech on how these coal trains will impact her life. There

is a movement on Facebook this week to change your photo to this image opposing

coal exports.

Coal exports are a prime example of people speaking out

against the momentum, and struggling to make inroads with the scale of these

heavily funded projects. Information is out there. People care. Last week, one

of my BGI classmates’ 10 year old daughter, Olive, stood up at a town hall

meeting to give a speech on how these coal trains will impact her life. There

is a movement on Facebook this week to change your photo to this image opposing

coal exports.

We are seeing public opportunities to share our opinions, but where

does that get us? Where in our current culture is the opportunity to shift the

momentum to make the shift Keynes spoke of in 1930, where “accumulation of

wealth is no longer of high social importance, there will be great changes in

the code of morals…the love of money as a possession…will be recognized for what

it is, a somewhat disgusting morbidity, one of those semicriminal,

semi-pathological propensities which one hands over with a shudder to the

specialists in mental disease.”

This is the change we need to make as a society. We can

teach and learn and tear apart the textbook understanding of the triple bottom

line. We can develop sustainable businesses within our communities, and support

those that balance these values. But what needs to happen to promote this

larger social change to challenge our economic structures and expectations of

growth?

Becoming aware, and recognizing our interactions with these

structures in our own experiences are paramount to start the change. We must

ask ourselves why we are pursuing what we are, and to what ends. We must

clearly understand our goals, and then uncover if our actions are actually

leading us in that direction. As Olive Lewis stated so eloquently in her plea

to the Spokane community, “is this the best we can do, or are we capable of

something greater?” Keynes whole essay is about the social change that needs to occur to impact the future for today's children, like Olive. I hope that we all can start making this progress, and take responsibility for our small contributions to this system. I want is to start this transition, so that future leaders and decision makers can start from a place more innovative from where we stand today.

"Hello. My name is Olive Lewis and I

am a 4th grader at Roosevelt Elementary. I live just four blocks from away from

the rail road tracks that will carry this coal.

I come from a family of railroad employees, including my papa. My papa is concerned about me breathing in the diesel fumes along with the risk of a spill from hazardous cargo.

I am here because I want to play in the World Cup someday. Soccer is my life, and I've already seen a doctor about my lungs. On days of poor air quality I cannot practice or play outside.

I understand the need for jobs, but they need to be the RIGHT jobs. My neighborhood is full of kids breathing the same air and our future cannot be sacrificed for short term gain.

I researched some studies on the potential impact on the air and general pollution to ship this coal to China, and I want to ask: 'is this the best we can do, or are we capable of something greater?'"

words by Olive Lewis, from the Spokane Riverkeeper

I come from a family of railroad employees, including my papa. My papa is concerned about me breathing in the diesel fumes along with the risk of a spill from hazardous cargo.

I am here because I want to play in the World Cup someday. Soccer is my life, and I've already seen a doctor about my lungs. On days of poor air quality I cannot practice or play outside.

I understand the need for jobs, but they need to be the RIGHT jobs. My neighborhood is full of kids breathing the same air and our future cannot be sacrificed for short term gain.

I researched some studies on the potential impact on the air and general pollution to ship this coal to China, and I want to ask: 'is this the best we can do, or are we capable of something greater?'"

words by Olive Lewis, from the Spokane Riverkeeper