This week we have been

focusing on globalization, processes that promote world-wide exchanges of

national and cultural resources. International trade has been in existence

since the earliest days of international exploration and human interaction. The

modern economy moves a multitude of goods across international lines,

everything from bananas and wheat to airplanes and cars.

This is a perfect tie to the

surge of interest in exporting US coal to Asia, mainly China. As referenced in

Norm’s blog, China is the center of globalization today. We are importing large quantities of goods and services from China, to the magnitude

of $539 billion in 2011 according to the Office of the United State TradeRepresentative. Exports totaled $129 billion; Imports totaled $411 billion. The

U.S. goods and services trade deficit with China was $282 billion in 2011.

International competitive

advantage trade theory would describe the coal trade system as the country with

the cheapest, easiest production of coal to be the most competitive in the

market. China boasts the world's third largest coal deposits, and leads the

world, both in the production and the consumption of coal. The United States on

the other hand, is the largest coal market open to foreign investors. Inaddition to being the second largest exporter of coal, the United States is the

world's second largest coal producer.

So how are recent changes in the coal market now making it competitive to

export coals from the US into China and other Asian countries from Pacific

Northwest ports?

My guess is limited resources globally,

couples with an explosion in demand for this energy resource. Coal consumption in

China increases at a rate of 10 percent a year, and continues to face

challenges of keeping up a domestic supply to meet this demand. This

increased demand in China is occurring at the same time the US is seeing a drop

in demand domestically. To ensure a long term market is accessible, they see

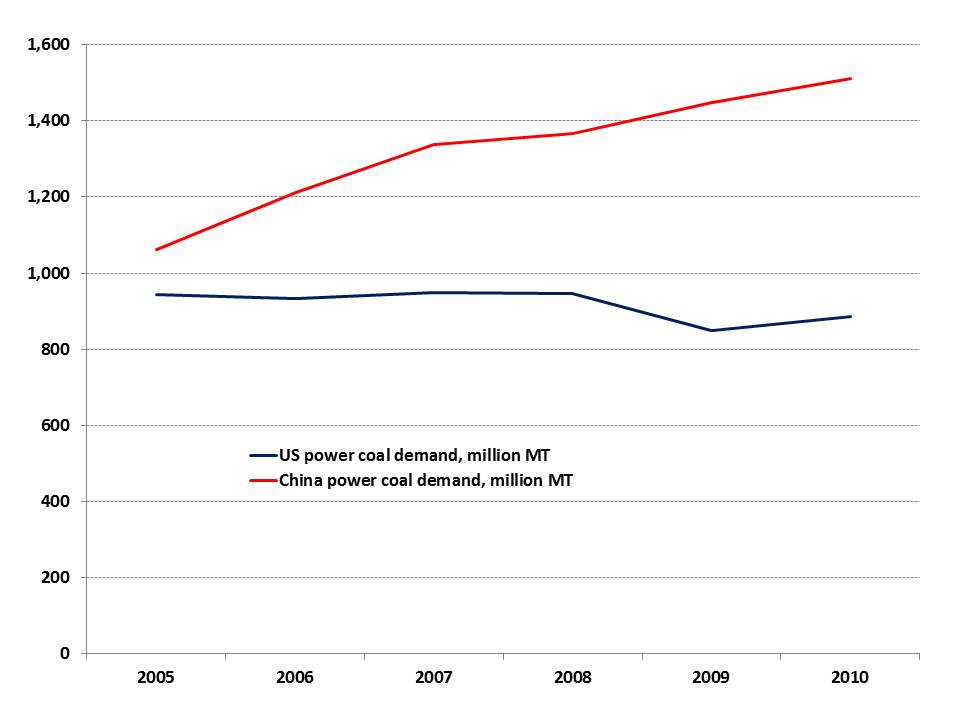

investment in export to China as a longer term project. The U.S. power generation sector saw demand fall by 1% between 2000 and 2010, while demand for

coal in China’s electric generation sector surged by 163% during that same time

to more than 1.5 billion tonnes per year.

It is expected that China

may import as much as 250 million tonnes of coal during 2012 (coking and

thermal coal combined). As such, Wyoming and Montana coal miners have a solid

opportunity to market their low-cost, clean burning Powder River Basin coal to

power plants in Coastal China.

It is expected that China

may import as much as 250 million tonnes of coal during 2012 (coking and

thermal coal combined). As such, Wyoming and Montana coal miners have a solid

opportunity to market their low-cost, clean burning Powder River Basin coal to

power plants in Coastal China.

Foreign investors have

become increasingly important in U.S. coal over the past decade or so. The industry is eyeing the region as a hub for export

because of its proximity to Asia, said Al Knapp, project manager for Ambre Energy.

He said multiple countries, including Japan, which is moving away from nuclear

power – are looking to coal as a cheap and reliable energy source. Presently,

most coal is shipped from the East Coast.

“I think there is an opportunity

in Asia, and like any good business person would want to do, you go where your

market is,” Knapp said. “The Pacific Northwest is the quickest route there.”

Coal industry experts predict that U.S. exports will surge to more than 100

million tons per year over the coming decade as consumption shifts away from

the United States, where electric utilities are relying increasingly on natural

gas and other fuel sources for power generation. The coal would go to emerging

markets in China, Southeast Asia, India and Latin America where coal remains a

primary fuel for electricity.

Even with a booming market, and a large supply of US coal, the export

project along the US West Coast is not a fast solution. The string of Pacific Northwest terminals

has garnered skepticism and outright opposition from those who believe a

massive coal terminal will diminish air and water quality in the region while

increasing noise, congestion and wait times at rail crossings. So the actuality

of this global coal market may take some time before it is realized from the

Pacific Northwest, and other coal exporting countries like Australia, Russia and South Africa

may be quicker to respond to this global market.

Hi Lauren, Thanks for bringing this issue up. I appreciate your comment on my blog regarding what if enough companies move from China back to the US, what if this coal export boom is temporary? What if!?!

ReplyDeleteThere are so many reasons this is a hot issue.

First, they want to export the coal in our backyard. Secondly, its contradictory, not to mention unethical, to start discussing cap and trade carbon taxes while exporting extreme carbon generating fuel to a country that is going to burn it. Third, this will impact the environment and health of so many people along the coal route. As they transport by train and semi truck, traffic and frequency is expected to increase, with it localized air pollution. More coal will need to be mined. People will be exposed to it at the ports. Every person and mile traveled from where its mined to China will experience some sort of unhealthy exposure.

Thanks for your post, Lauren. You continue to do a good job of linking what we're learning in Economics to your hot button issue: coal exports through the Northwest.

ReplyDeleteIt will be interesting to see how the Chinese energy sector develops and what point they are able to meet a large enough percentage of their energy requirements from renewables that they won't have to rely so much on coal. That could be completely out of the current time frame -- or it could be closer than we think.

Either way, one of the sad parts for the US is that we are exporting raw materials (coal, timber, food) and importing value- added products from which China (and others) reap the jobs and economic profits. Yet another good reason to return manufacturing to the US.